- This event has passed.

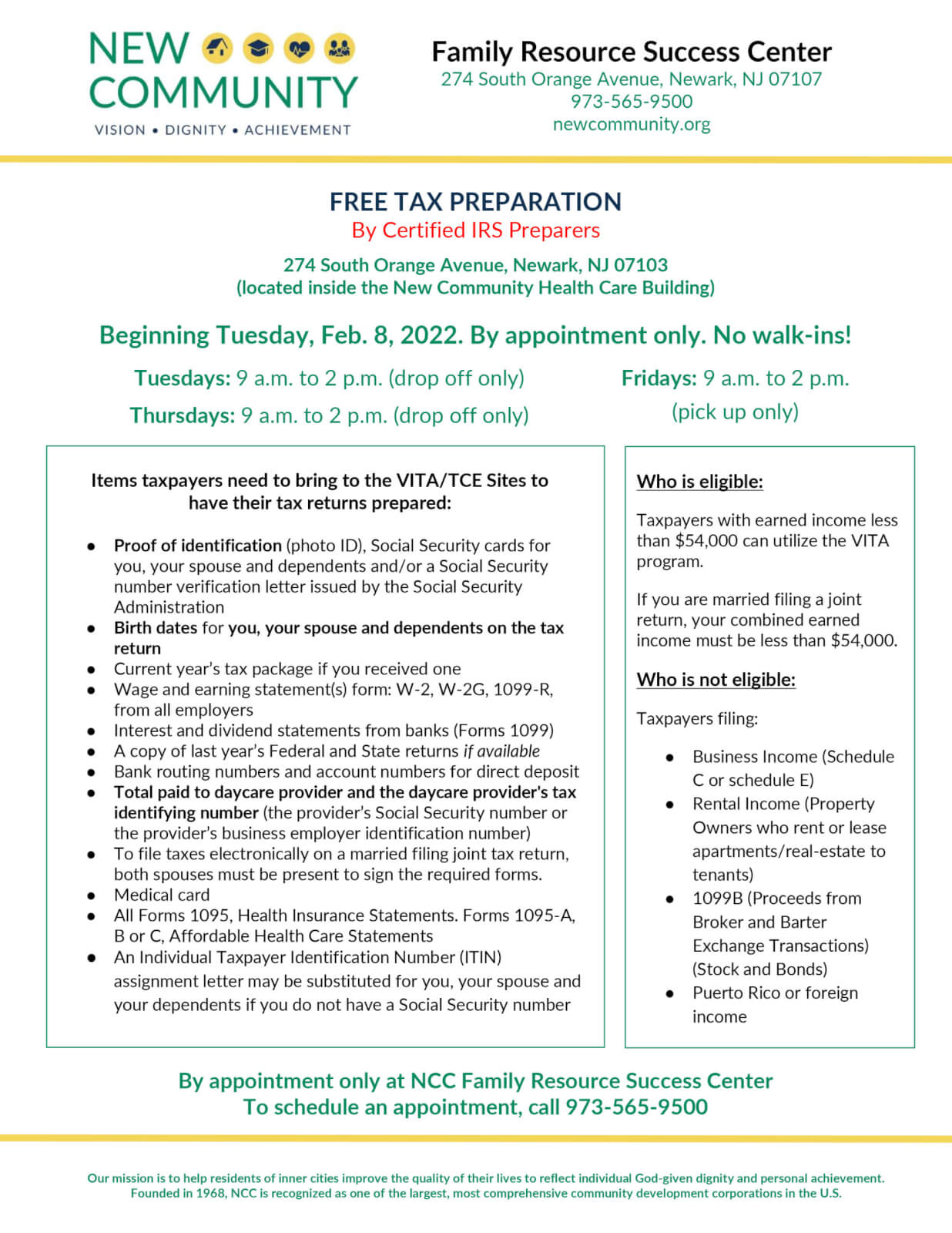

Free Tax Prep (drop off by appointment only)

March 31, 2022 @ 9:00 am - 2:00 pm

Free

By Certified IRS Preparers

274 South Orange Avenue, Newark, NJ 07103

(located inside the New Community Health Care Building)

By appointment only at NCC Family Resource Success Center

To schedule an appointment, call 973-565-9500

Beginning Tuesday, Feb. 8, 2022

Tuesdays: 9 a.m. to 2 p.m. (drop off only)

Thursdays: 9 a.m. to 2 p.m. (drop off only)

Fridays: 9 a.m. to 2 p.m. (pick up only)

Items taxpayers need to bring to the VITA/TCE Sites to have their tax returns prepared:

- Proof of identification (photo ID), Social Security cards for you, your spouse and dependents and/or a Social Security number verification letter issued by the Social Security Administration

- Birth dates for you, your spouse and dependents on the tax return

- Current year’s tax package if you received one

- Wage and earning statement(s) form: W-2, W-2G, 1099-R, from all employers

- Interest and dividend statements from banks (Forms 1099)

- A copy of last year’s Federal and State returns if available

- Bank routing numbers and account numbers for direct deposit

- Total paid to daycare provider and the daycare provider’s tax identifying number (the provider’s Social Security number or the provider’s business employer identification number)

- To file taxes electronically on a married filing joint tax return, both spouses must be present to sign the required forms.

- Medical card

- All Forms 1095, Health Insurance Statements. Forms 1095-A, B or C, Affordable Health Care Statements

- An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted for you, your spouse and your dependents if you do not have a Social Security number

Who is eligible:

Taxpayers with earned income less than $54,000 can utilize the VITA program.

If you are married filing a joint return, your combined earned income must be less than $54,000.

Who is not eligible:

Taxpayers filing:

- Business Income (Schedule C or Schedule E)

- Rental Income (Property Owners who rent or lease apartments/real-estate to tenants)

- 1099B (Proceeds from Broker and Barter Exchange Transactions) (Stock and Bonds)

- Puerto Rico or foreign income